Customer lifetime value (CLV or LTV) is a crucial metric that represents the total profit a customer generates for a business over the course of their relationship. Rather than focusing solely on the revenue from individual transactions, CLV considers the net profit contributed by a customer, accounting for the costs associated with acquiring, serving, and retaining that customer. These are important considerations to ensure the metrics your team aims for don't improve customer growth at the cost of profitability, which is an easy way to tank an otherwise good company.

Improving and optimizing CLV is one of the most valuable metrics for driving business profitability and sustainability, which can give you the time and funds you need to help the business grow. By increasing the lifetime value of each customer, companies can enjoy higher profit margins and achieve long-term financial success. A higher CLV indicates that customers are not only spending more but also costing less to maintain, resulting in a healthier bottom line.

Moreover, improving CLV is a cost-effective approach to growing a business because it's more affordable to retain and increase value from customers who already have a relationship with your company. Studies have shown that acquiring a new customer costs five times more than retaining an existing one, and customers who already have a relationship with your business tend to be more profitable than newly acquired customers. Research indicates that loyal customers spend 67% more than new customers. Existing customers are more likely to make repeat purchases, buy higher-margin products, and refer others. By allocating resources to enhance the experience and profitability of current customers, companies can boost retention rates and reduce the reliance on costly acquisition campaigns.

How to Calculate Customer Lifetime Value

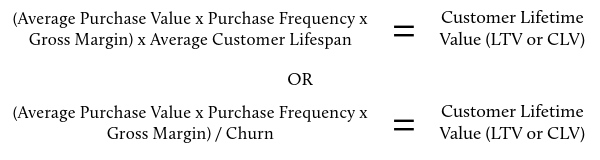

The basic formula to calculate customer lifetime value (CLV or LTV) is:

LTV = (Average Purchase Value x Purchase Frequency x Gross Margin) x Average Customer Lifespan

Or

LTV = (Average Purchase Value x Purchase Frequency x Gross Margin) / Churn

While the calculation is the same either way, SaaS companies very often focus on churn since their customer's revenue is most often recurring in set periods and dependable. Churn is a metric SaaS companies usually track, so it's easy to plug into the calculation. Other business types have customers who make irregular purchases over the lifetime of their experience, and they may not know if or when the next purchase will occur.

For these businesses, it's easier to calculate the average lifespan of a customer by utilizing the first and most recent purchases of all customers and then averaging those results (potentially leaving off new single-purchase customers if that's weighting down the data based on the likelihood of additional purchases). We see the average customer lifespan calculation more often used for service-based businesses or traditional business models where recurring revenue is more challenging to forecast or when they don't readily have any other data like churn available. Since both methods are just inverse ways of telling how long a customer works with an organization, choose whichever calculation is more straightforward to gather for your team.

Here's a breakdown of each component:

- Average Purchase Value: The average amount a customer spends on a single transaction.

- Purchase Frequency: The average number of purchases a customer makes in a given time period, usually a year.

- Gross Margin: The profit percentage earned on each sale subtracting the cost of goods sold (COGS). It's calculated as (Total Revenue - COGS) / Revenue. You'll sometimes see this calculation without the divider, but since we're trying to get a multiplying factor instead of just a dollar amount, we divide by revenue to use in our calculation.

- Average Customer Lifespan or Churn: The average length of time a customer remains active with the company before no longer making any further purchases. For things like average lifespan, consider removing any outliers in the uppermost or lower-most values unless there's enough volume on either end to consider them indicative of your customer's spending habits.

While we often recommend median values in many business metrics calculations, as they can be more reliable to use as barometers than averages, the median is not used in this calculation since the formula includes other averages. Ultimately, it's up to you to decide whether to be conservative or loose with your LTV calculation and find the values that show you the best value to use.

Since this measure is a lagging indicator rather than an accurate forecast, because you're using past behaviors to assume future profits from similar customers, we usually recommend being more conservative to avoid overestimating future investments based on something that can change drastically without much warning. As long as the values are truly indicative of the likelihood of expected purchases, the calculation should be fine to use. Data doesn't lie, so your results should roughly align with this calculation's estimates over time unless you're miscalculating something.

Lifetime Value Calculations

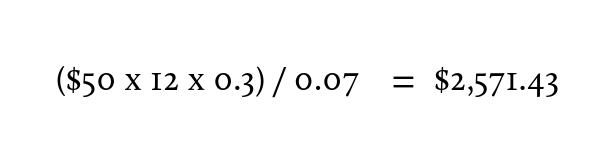

As a potential SaaS example, the average customer spends $50 per transaction, makes 12 purchases per year, and your churn rate is 7%. If the gross margin on each sale is 30%, the LTV calculation would be:

($50 x 12 x 0.3) / 0.07 = $2,571.43

So, the estimated lifetime profit generated by an average customer is roughly $2500 if you round down to focus on conservative estimates.

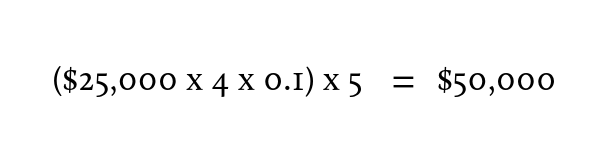

As a potential service business example, the average customer spends $25,000 per transaction, makes 4 purchases per year, and remains a customer for 5 years on average. If the gross margin on each sale is 10%, the LTV calculation would be:

($25,000 x 4 x 0.1) x 5 = $50,000

In this case, the LTV is much higher due to the overall value of a contract, even though the frequency and margins are lower. Many SaaS businesses only provide limited customer service to small businesses or single users because the cost to service (CTS) from customer service expenses can lower LTV and very quickly eat away at their profit margins. They often focus on enterprise customers who bring a large group of users for every recurring purchase, bringing LTV in line with or even exceeding many service-based businesses.

While this article isn't specifically about comparing business types or industries, it's important to know the business you are in or considering. LTV can be used to compare different organizations or potential opportunities for new products, services, and customer bases. The specific inputs and time periods can vary based on the business model and available data. However, the core principle is calculating the net profit a customer contributes over their lifetime rather than just the gross revenue.

By measuring LTV as a function of profitability, businesses can optimize customer acquisition costs, retention strategies, pricing, and product offerings to maximize the long-term profit potential of the customer base. Tracking LTV helps keep a pulse on the business's overall financial health and sustainability, which is why we often help our customers automate the calculation for this metric and add it to prominent dashboards for leadership to monitor.

Strategies to Increase Customer Lifetime Value

Increasing customer lifetime value (LTV) should be a top priority for any business looking to drive long-term growth and profitability. Here are several proven strategies to boost LTV by enhancing the customer experience, encouraging loyalty, and maximizing the value each customer provides.

1. Improve Onboarding and Customer Education

Effective onboarding is crucial for setting customers up for success from day one. By providing comprehensive education and training, you empower users to fully utilize your product or service and quickly realize its value. Consider offering interactive walkthroughs, video tutorials, webinars, and a robust knowledge base to guide customers through key features and use cases. For service-based businesses, having effective operations teams and account management teams to support getting projects stood up and completed as efficiently as possible is key.

2. Provide Exceptional Customer Service and Support

Delivering outstanding customer service builds solid and lasting relationships. Promptly address inquiries, offer multiple support channels (e.g., phone, email, live chat), and go above and beyond to resolve issues while monitoring the labor costs spent within the LTV. Train your support team to empathize with the customer, be knowledgeable, and focus on solutions. Arguing with customers, going back and forth without providing clear answers, or exceptionally long delays between points of communication before resolution will likely mean more outreach by the customer, costing you time and taking additional profit margin off your LTV. Ensure your customer service team has the knowledge and power to resolve customer inquiries rapidly. Exceptional service fosters trust, loyalty, and positive word-of-mouth, driving up LTV and creating opportunities to acquire new customers more efficiently.

3. Personalize the Customer Experience

Tailor the customer journey to individual preferences, behaviors, and needs. Use data and insights to provide relevant product recommendations, targeted content, and customized offers. Personalization helps customers connect with your brand, increasing engagement, satisfaction, and repeat purchases. For service-based businesses, check in regularly enough to build and maintain the relationship. While thinking of revenue shouldn't always be the core reason for the outreach, every touch point is an opportunity to identify new pain points that your organization can resolve and a chance to increase LTV.

4. Implement a Customer Loyalty or Rewards Program

Incentivize repeat business by encouraging customers to spend more with a well-designed loyalty program. Offer points, discounts, exclusive perks, or tiered benefits based on purchase history or engagement levels. Loyalty programs not only increase retention but also provide valuable data for personalization efforts. Even service-based businesses should consider some form of ongoing subscription model to help lock in customers - just make sure any rollover hours or services that go unused have an expiration date to avoid overloading your team with work if a customer decides to use a bunch of hours all at once.

5. Encourage Customers to Buy More Through Upselling and Cross-Selling

Identify opportunities to increase average order value by suggesting complementary products, upgrades, or premium versions of what customers are already buying. Use data to present relevant, timely upsell and cross-sell offers that genuinely add value for the customer. When done right, these tactics boost revenue while improving the customer experience. There are many poor examples of upselling or cross-selling that you can learn from to avoid implementing a bad strategy.

For instance, I have a SaaS product I purchased at one of the highest tiers they had; it's even called Ultimate 360 or something that seems all-encompassing. Yet, nearly every other day, I get some form of notification about additional products that constitute yet another level. Constant nagging is not an upsell strategy. In fact, I am looking into replacing that product right now to end the tyranny. Make sure you're adjusting your plan based on customer feedback, or just put yourself in their shoes to understand how that strategy would feel. Otherwise, you risk losing customers over something entirely within your control.

6. Leverage User-Generated Content and Referrals

Encourage satisfied customers to share their experiences, write reviews, or create content featuring your brand. User-generated content is powerful social proof, influencing purchase decisions and attracting new customers. Start a referral program to reward customers for bringing in new business, tapping into their networks, and expanding their reach. Some of the most effective programs create a bonus opportunity for the referring party and the new customer. These programs can help drive the referral past the point of purchase because it's an offer that many other companies won't be able to match due to the referring parties' relationship with your organization. If you want to avoid risking cash payments on this program, offer a few free services that cost a little time or don't increase your fixed costs, such as a bonus tier or an add-on from your SaaS product for each party instead of cold hard cash.

7. Regularly Engage Customers with Targeted Campaigns

Keep your brand top-of-mind by nurturing customer relationships through ongoing, personalized communication. Use email, SMS, push notifications, or social media to share valuable content, product updates, special promotions, or helpful tips. Segment your audience to ensure each message resonates and adds value. Just remember to keep your data up to date. There's no reason to continue marketing to a customer you are sure is done with your business, at least for a while.

This recommendation is especially true if the marketing is for the exact same products they just canceled. For subscription-based models, you may even want to set up some automated price-lowering offer before they cancel to see if you can continue receiving value from the relationship. While this can also help you identify if pricing needs to change, be careful standardizing and offering this too much as customers may catch on and feign leaving to drive down their recurring payments.

Make sure to check with your legal team if there are any legal requirements or potential discrimination laws you may break by offering this to select customers or only under certain conditions. In most cases, what you provide for one customer must be available to others unless you outline specific terms and conditions that are known ahead of time, so this can be a problematic area without legal team review.

8. Collect Customer Feedback and Act on It

Actively seek feedback through surveys, reviews, or direct outreach to understand customers' needs, preferences, and pain points. Use these insights to upgrade your products, services, and overall experience. Show customers you value their input by implementing changes based on their suggestions and informing them of changes they may benefit from. Each touch point is an opportunity to provide additional value and capture additional revenue, potentially increasing LTV.

9. Offer a Customer-Centric Product or Service with High Value

Ultimately, the most effective way to increase LTV is by offering a product or service that consistently delivers exceptional value to customers. Continuously gather feedback, innovate, and iterate to ensure your offering solves real problems and meets evolving needs. No amount of marketing, sales relationship building, or even excellent customer service can save a business with poor products or services. A customer-centric approach, combined with the strategies above, will create a loyal customer base that drives sustainable growth.

By implementing these strategies, businesses can create a virtuous cycle of customer satisfaction, loyalty, and profitability. Investing in the customer experience and prioritizing long-term relationships over short-term gains is the key to maximizing customer lifetime value and driving enduring success. Remember to monitor the customer's lifetime value to ensure you aren't eating into profits when considering new opportunities to drive additional revenue.

Measuring the Impact on Customer Lifetime Value

After implementing strategies to increase customer lifetime value, track the impact of your efforts over time. Regularly measuring LTV will help you understand which initiatives are most effective and where you may need to make adjustments. Since you're using historical data, which changes, updating any forecasts you have as underlying LTV metrics change is essential.

Tracking Improvements in LTV

One key metric to monitor is the overall LTV itself. By tracking improvements in LTV over time, you can quantify the cumulative impact of your strategies. Calculate LTV monthly or quarterly and compare it to previous records to identify positive or negative trends. An increasing LTV indicates your initiatives are paying off, while a decreasing LTV may signal the need to re-evaluate your approach. However, since LTV is a long-term metric that can take time to reflect changes, tracking leading indicators contributing to lifetime value is essential.

Monitoring Related Metrics

Customer retention rate is a critical metric to watch, as improvements in retention directly impact LTV. Track your retention rate over time, especially after implementing new strategies to reduce churn. An increasing retention rate is a strong sign that your efforts are working and should eventually translate into a higher LTV.

Similarly, your team should closely monitor changes in average order value and purchase frequency. Increases in these metrics, whether due to successful upselling, cross-selling, or loyalty programs, will drive higher lifetime value. Tracking these granular metrics provides a more immediate pulse on the efficacy of your initiatives.

Finally, gross margin and impacts changing the cost to service (CTS) are vital considerations. Margin by product or service line changes over the product/service lifecycle. Understanding which area of the product or service lifecycle can help you proactively adjust to potential changes in LTV ahead of time. Similar to a marketing department's channel mix modeling, you can review the LTV and gross margin by product or service line to optimize for a net profit margin as long as your organization is willing to adjust to meet consumer demands rather than hold on to legacy products/services as they become unprofitable.

Conducting Cohort Analysis

Cohort analysis is a powerful tool for measuring the impact of LTV initiatives. By comparing the lifetime value of different customer segments, such as those acquired before and after implementing a change, you can isolate the effect of specific strategies. For example, compare the LTV of customers who participated in a new loyalty program versus those who didn't. Or analyze the LTV of customer cohorts acquired through different marketing channels to determine which sources bring in the most valuable customers. This granular approach helps pinpoint which tactics are moving the needle and allows you to optimize your efforts accordingly.

Calculating Return on Investment

Similar to cohort analysis, to truly understand the impact of your LTV initiatives, calculate each strategy's return on investment (ROI). Measure the incremental lift in LTV generated by a specific tactic and compare it to the cost of implementing that initiative.

For instance, if a new customer onboarding program results in a 10% increase in LTV, calculate the total additional revenue generated across the customers exposed to that program. Then, subtract the costs of developing and running the program to determine the net ROI.

Tracking ROI ensures you're allocating resources to the most impactful initiatives and helps justify further investment in successful strategies. By considering cohort analysis alongside strategy-specific ROI analysis, you can find the optimal balance of the right strategy for each customer group.

Small Changes Have a Large Impact at Scale

Measuring the impact of your LTV efforts is an ongoing process. Review your metrics regularly, conduct cohort analyses, and calculate ROI to identify areas for improvement. Don't be afraid to experiment with new tactics, but always measure their impact and be prepared to iterate based on the results. Over time, by continuously monitoring, optimizing, and fine-tuning your approach, you can maximize the lifetime value of your customer base and constantly outpace your competition.

Tracking and analyzing these numbers will be a significant process for most businesses, so we recommend automating the data collection and reporting as much as possible. That way, it's easier for your team to understand which metrics their work influences, how to optimize their contributions for profitable results, and what areas to improve. Remember, even minor improvements in LTV can have a substantial cumulative impact when compounded across your entire customer base and extended over the customer's lifetime.